cumulative preferred stockholders have the right to receive

If preferred stock is designated as cumulative the suspended dividends accumulate and you must later pay them in full. Sell or transfer any of their shares.

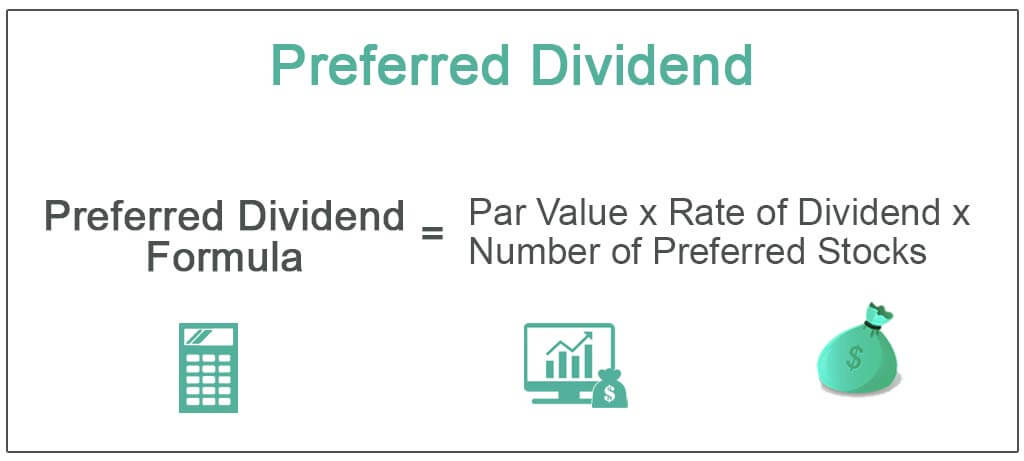

Preferred Dividend Definition Formula How To Calculate

Cumulative preferred stocks right to receive dividends is forfeited in any year that dividends are not declared.

. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. Dividends are paid out regularly such as quarterly or annually. If the dividends are delayed for more than six consecutive quarters the shareholders will have the right to elect two additional directors.

It is a clause that also gives preferred stock holders priority of accumulated dividends over common stockholders in the event that the underlying asset. Cumulative preferred stockholders receive a dividend that is paid to them on the same date each year. Priority preferred Preemptive preferred Dividends are not paid 10 preferred stockholders.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. If you LIKE dividends youll LOVE Dividend Detective. Common and Preferred Stock.

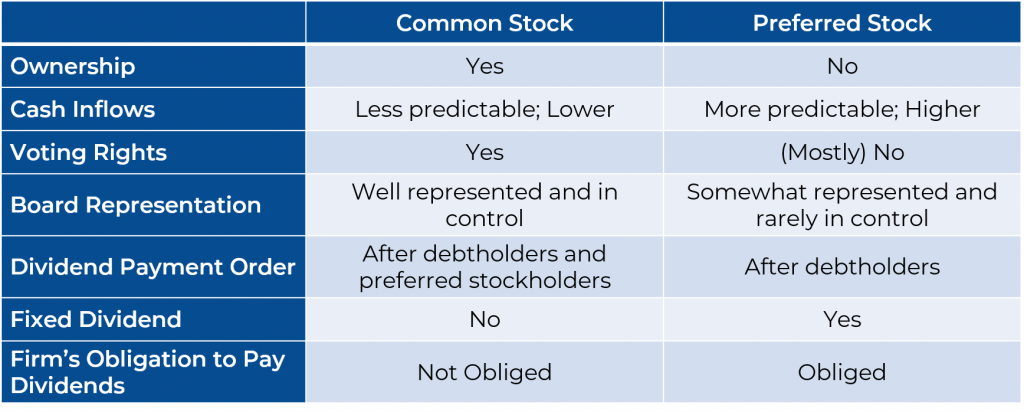

Preferred stocks typically have fixed dividend payments based on the stocks par value. Buy additional newly issued shares in a proportion equal to the percentage of shares they already own called the preemptive right receive a dividend when declared receive a portion. These dividends are not carried over to subsequent years.

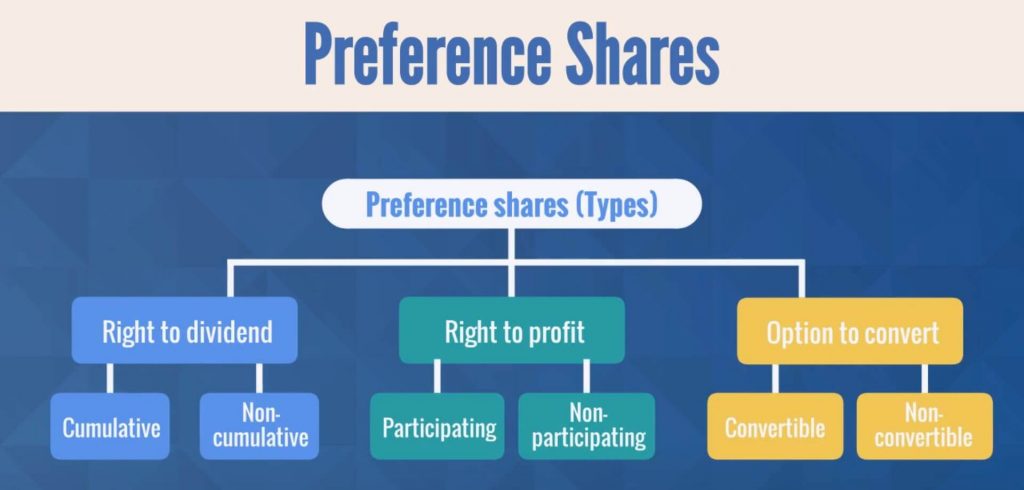

However stock proceeds from issuing cumulative preferred shares are considered to be an asset. Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the normally specified rate that preferred. You may retain the right to suspend payment of dividends.

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past the dividends owed must be paid out to. This type of preferred stockis oled Cumulative preferred. However in some cases cumulative.

Ad How to Avoid Picking Losers. Cumulative preferred stockholders have the right to receive dividends in arrears when dividends are subsequently declared. Preferred shares are the most common type of share class that provides the right to receive cumulative dividends.

This dividend is payable quarterly semi-annually or annually. If a company is unable to distribute dividends to shareholders in the period owed the dividends owed are carried forward until they are paid. Cumulative preferred stock contains a provision requiring that any missed dividend payments be paid out to.

B have the right to receive dividends only if there are enough dividends to pay common stockholders too c must receive more dividends per share than the common stockholders d must receive dividends every year. As referenced above cumulative preferred stock is a type of preferred stock. The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600.

A have the right to receive dividends only in the years the board of directors declares dividends. However noncumulative stocks undeclared dividends accumulate each year until paid. Cumulative preferred stock shareholders are treated differently because they have the right to receive a dividend whether one is declared or not.

A participating feature gives preferred shareholders the right to receive a share of dividends paid to common shareholders. Participating preferred stock gives the holder the right to a specific dividend which is separate from the dividends common stockholders receive and is also received before common stockholders. All corporations have common stock.

Traditionally cumulative preferred stocks have a stated dividend yield that is based on the par value of the share. And the right to receive repayment of invested amounts before any such redemption payments may be made to common stockholders if the management decides to liquidate the company. A cumulative dividend is a required fixed distribution of earnings made to shareholders.

C Both common and preferred stockholders have. Common stock provides the following rights to shareholders. The guaranteed dividend for these shareholders means that when dividends are in arrears this is a term that means when dividends are not paid out by the company cumulative preferred stock.

Preferred stock valuation is similar in nature to bond valuation.

Arrearages Meaning Example Uses And More In 2022 Accounting And Finance Financial Management Meant To Be

What Is Preferred Stock Is It Right For My Portfolio Nerdwallet

Learn About Shareholders Rights Preferred Stock Preferred Shares Chegg Com

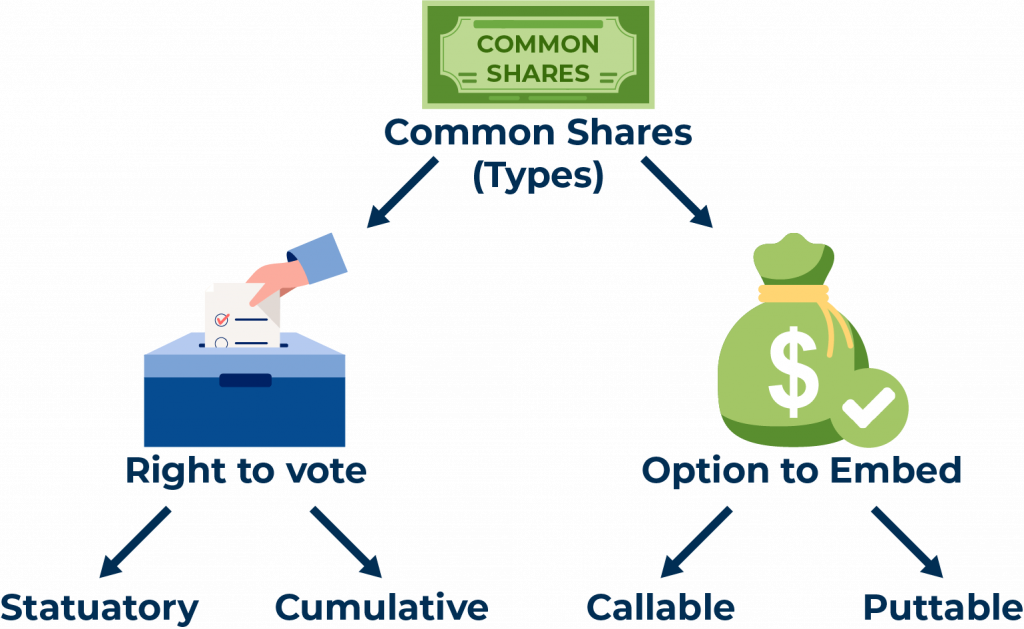

Common Shares Vs Preferred Shares Comparison Of Equity Types

Common And Preferred Stock Principlesofaccounting Com

Which Of The Following Typically Applies To Common Stock But Not To Preferred Stock In 2022 Common Stock Preferred Stock How To Apply

Learn About Shareholders Rights Preferred Stock Preferred Shares Chegg Com

Common Shares Vs Preferred Shares Comparison Of Equity Types

/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)

Noncumulative Definition And Examples

Learn About Shareholders Rights Preferred Stock Preferred Shares Chegg Com

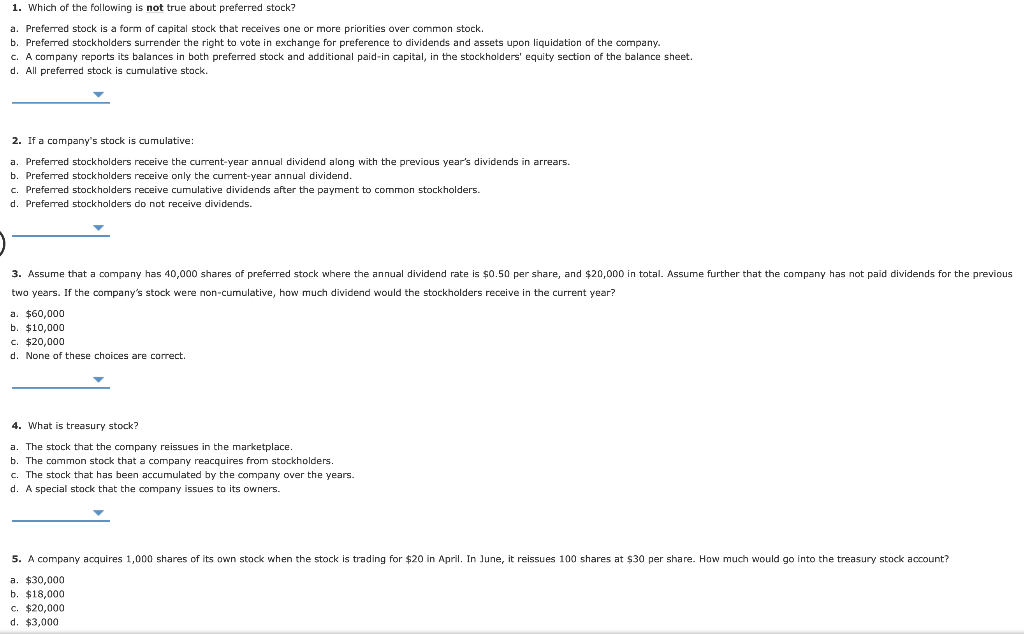

Solved 1 Which Of The Following Is Not True About Preferred Chegg Com

What Is Preferred Stock Definition Pros Cons Thestreet

Common Stock Vs Preferred Stock 365 Financial Analyst

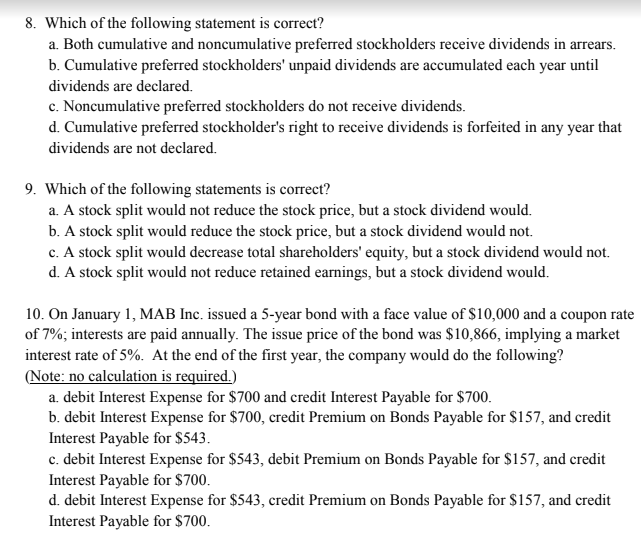

Solved 8 Which Of The Following Statement Is Correct A Chegg Com

Common Stock Vs Preferred Stock 365 Financial Analyst